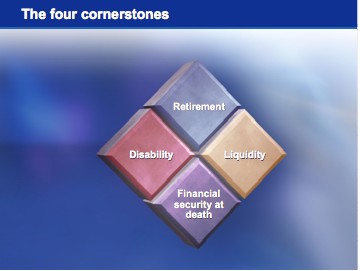

The four cornerstones of financial security planning

A sound financial security plan should protect you against uncontrollable events such as disabilities or death, while helping you plan for controllable events such as buying a new home and retiring comfortably. To do this, our planning process is based on four cornerstones of financial security planning:

- Financial security at death

- Retirement

- Liquidity

- Disability and critical illness

Financial security at death

All financial security plans start here because death is inevitable and an uncontrollable event. As part of the financial security planning process, we’ll discuss:

- How much income will your family need if you die?

- How will inflation affect this income?

- How to preserve your estate for your family when you die

Retirement

When we discuss retirement planning, we consider:

- What kind of lifestyle do you see for yourself in retirement?

- How much money will you need to retire comfortably?

- What impact will inflation have on your income?

- Would you like to have the freedom to slow down or retire early?

Time and planning are two factors that influence whether or not you accomplish your retirement goals. Therefore, you must work towards your retirement goals over time.

Liquidity

Liquidity is your ability to access cash or assets that are easily convertible to cash. Liquidity can be a short term savings option that can regenerate over time and need your constant hard work.

Disability and critical illness

Mitigating your risk against uncontrollable events such as disability or critical illness is key to your financial security. When building your financial security plan, we’ll consider:

- Will your income be reduced in the event of disability or critical illness?

- If your income is reduced, will it be difficult for you to maintain your lifestyle and retirement savings?

- How much disability or critical illness insurance coverage is enough?

- What impact will inflation have on your income if you’re unable to work for a long time?

- Do you know if your group benefits provide a provision to allow you to continue your retirement savings if you become disabled or suffer a critical condition or illness?

Arrange to meet with us today* to find out more about these four cornerstones and how they can be part of your financial security plan.